If you invested in Custodian Real Estate in Melbourne, you have made $60,000 to $100,000 in the last 6 months of 2016. We had a client buy in West Melbourne suburbs in July for $370,000. Westpac bank just revalued it at $422,000; that’s an uplift of nearly 15% in 6 months. What’s exciting is that Westpac Valuations are often low too; in fact they valued the property 6 months ago at $362,000 – or $8,000 under purchase price. The Melbourne outer ring, where Custodians own just over 1,500 properties has now kicked in, as Sydney did in late 2015 – early 2016. When it happens, it happens very quickly. This year will be very exciting for us as Real Estate investors. Double digit growth in all East Coast states and yes even the sleeping giant, Brisbane, is coming to life. Crazy to think you can still buy there with a 5% rental return. This time last year I forecast double digit growth for Sydney and Melbourne against a backdrop of economists and Real Estate experts who were predicting on average 3-5% growth and many even announcing a falling housing market.

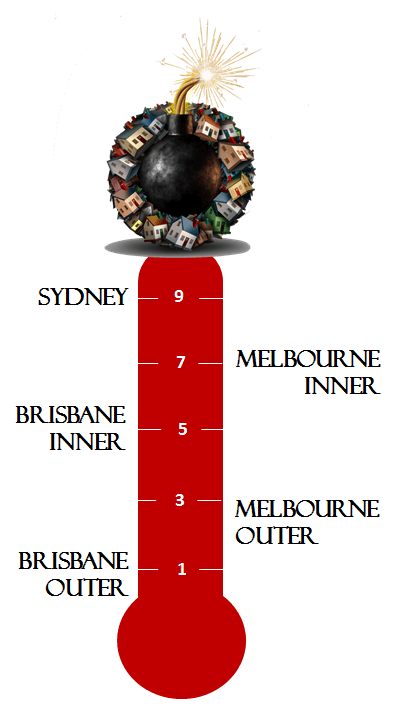

We are midway through a major property boom. What does that mean? In numbers it means if 10 is where the boom will go to, Sydney is a 9, Melbourne inner is a 7 and outer is a 3 now with a rocket. Brisbane inner is a 5 and outer is a 1, also with a rocket. (see illustration to the right). Brisbane $3billion new Casino has officially started works. That’s a game changer for Brisbane and to me a bell ringing heralding jobs, migration and accelerated price growth. I started in this business in 1980. Brisbane was flat from 1981 to 1988. I’ve told the story before to many of you but I remember buying 1,000 m² lots for $16,000 in 1986. I sold some of them in 1987 and early 1988 for $18-$19,000. By the end of 1988 they were all worth $34,000 and by 1991 those blocks were worth $64,000. Clients tell me the reason they listen to me is for my focus on land, experience and motivation to stay the distance. In my mind, you can only make 2 mistakes: one is putting off buying and the other is selling. Make sure you’re on our first webinar for the year in a couple of weeks. We have pushed it out to mid-February as we wanted to put together some concise numbers, forecasting where this year will take us; we’re just waiting for some year-end numbers to come in to get the full picture.