The Difference Between Real Estate and Property

Land values have grown significantly faster than house prices in every capital city.

At Custodian, we KNOW real estate is the path to growth and wealth and that “property” is simply what sits on the real estate to give us cash flow and leverage. So why does land outperform? It’s all to do with supply and demand.

Land is a commodity which is limited in supply. You can’t make any more. The demand for land continually grows as the population increases. “Bricks and mortar” is not in limited supply. Land increased in value by nearly twice as much as house values over the past 30 years.

How Custodian Targets Property

Unfortunately, if you are starting out with limited capital you can’t just buy land: you need a vehicle for generating income to service your debt.

That vehicle is the rental property. But knowing that the land is the appreciating component, you need to acquire rental properties with the highest possible component of land value.

We are growth-focused investors. We want to maximise our growth and our leverage.

These are our 2 rules when choosing a property:

1. It’s the land that appreciates. We work to get the largest land content (+40%) at the lowest price per square metre.

2. We look for the fastest long-term population growth areas that will demand infrastructure and, in the future, higher-density land use to provide us with both short-term growth and long-term continual growth.

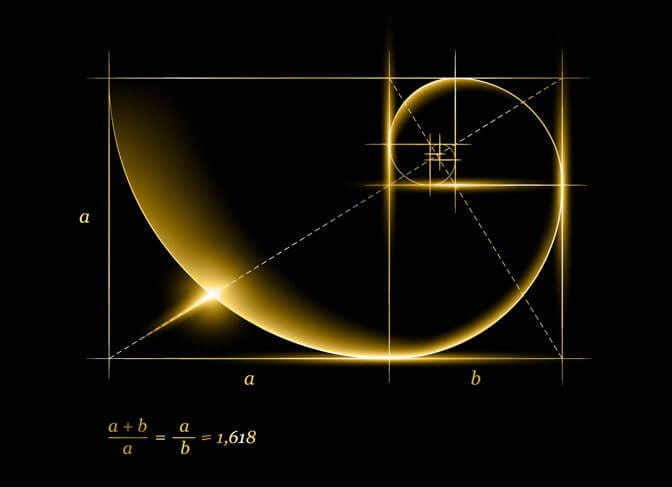

The golden investment property price ratio of 40% Land; 60% Property

A minimum of 40 percent land component will maximise your capital and equity growth potential while a 60 percent building portion is still substantial enough to attract a decent rental amount to service most of your property investment costs.

(Of course, a higher land proportion would be even better – you can always improve a building later, but you can’t create land).

So, 2 very important questions:

1. How can you use this strategy to build wealth?

2. Where do you find investment property with such a high land-component of 40% or more?

Compound Growth – A Financial Miracle

When we talk about ‘wealth building’, we are talking about establishing a structure and plan to manage your cash flow so you can acquire and hold residential real estate for capital growth. This will allow you to grow in wealth as the value of your investment increases. Your investment may, of course, also offer you income and tax advantages. But it’s the capital growth from land appreciation that counts.

It’s the capital growth – combined with compound growth from reinvestment – that makes millionaires.

You start with one property and use its capital growth (average 8% per annum) as a springboard to acquiring more properties and that gives you a solid potential for serious wealth.

That covers the how you can build wealth part. As to where to find these mystical 40:60 investment properties? Talk to us! We have some tightly-guarded investment properties that meet our 2 rules above that we’d love to show you! Book a free phone appointment to chat to one of our investment consultants now. We’d be happy to answer your questions.

DISCLAIMER