Welcome everyone to the December wrap, our final report for 2022, this one tied with tinsel!

And the great news is that Christmas has come early for Custodians, and all those who recognize the enduring value in staying the course and always looking around those corners.

The property market has turned around again. And the smart money is on investors going hard buying property today.

The big news, and this is really big news, is that in the last few weeks, we have witnessed the highest sale price of land per square metre in Australia’s history.

In paying that record price, one of Australia’s wealthiest people has demonstrated their ongoing conviction in the property market.

The 2,800 sqm block in Central Sydney sold for over $840 million, a record $300,000 per sqm, nearly twice the previous record of $160,000 per sqm. That is a phenomenal uplift, nearly doubling the former record.

In other great Christmas news for Custodians, the RBA has put a soft handbrake on rate rises, and I anticipate the big rate jumps have now come to an end, given inflation is down by 6.9%.

We’ve also enjoyed a massive uptick in the budget announced in November when the Federal

Government forecast coal prices would collapse to $60 / tonne – prices are still at $362 / tonne.

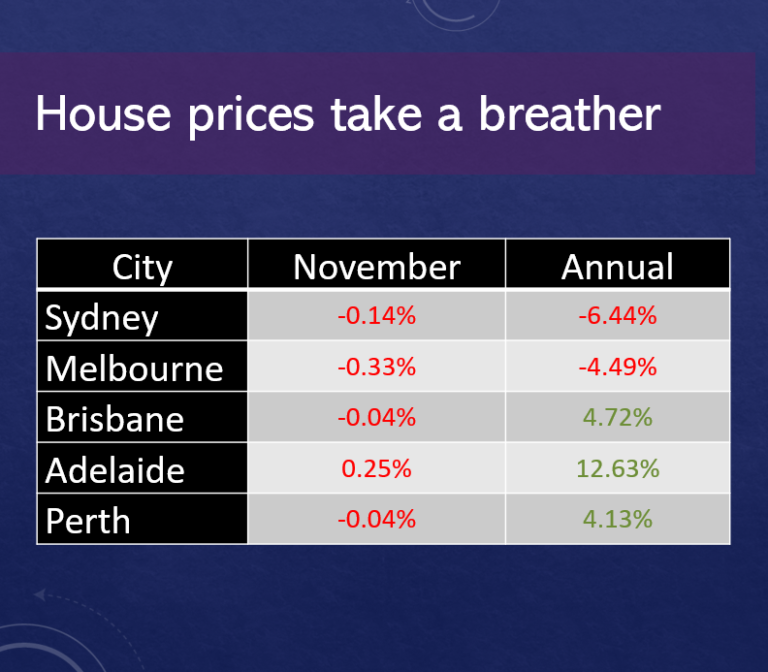

The budget is now way in front, the cash rate has returned to its normal position and every housing market across Australia has slowed from their two to three percent falls.

In fact, auction clearance rates and volumes are both up, with clearance rates well over 60%.

As many of you know, in property, if clearance rates are over 60% the market is considered to be going up, if below 60% the market is going down.

We saw records being set particularly in Sydney, with one apartment for example selling a massive 22% above the reserve, and in Brisbane a new suburb record was smashed, with a Sydney buyer paying $4.2 million, well above previous suburb sales. Expect much of the same to come, particularly as Brisbane steams towards the 2032 Olympics.

In Pimpama, where hundreds of Custodian clients have investments, a three-bedroom 219sqm house on 432sqm, recently sold in 7 days for $840,000. Most of our clients have paid half that price or less for four-bedroom homes on bigger blocks.

Pimpama is one of the hottest growth areas in Australia.

When we first started selling Pimpama, house and land packages were around $157,000, with blocks nearly double the size of this recent property sale. This area is a great example of how the Custodian system really works.

In another Christmas cracker of a story, a wonderful client recently contacted me to share the news that he had sold a house in Derrimut, Victoria for $725,000, producing a 120% gain in 12 years, and in even better news, he owns the three houses next door which he can sell off as needed.

The Christmas Story here is how taking a leap of faith, with trusted advice, delivers dividends. I’ve seen it time and time again. And it puts a big smile on my face to know that client is set.

The markets inevitably turn to our favour as a result of supply versus demand, and it is now undisputed that supply is going to continue to fall short and increasingly so for many, many years to come.

Sales have nearly doubled in the last two to three years, with listings down significantly, Brisbane and Adelaide seeing the lowest supplies of stock I have seen in 40 years, with less than half their ten-year average of stock for sale. This, at a time when there is a growing number of infrastructure jobs, with new hospitals and schools being built, and a desperate need for essential workers.

In Sydney, of 400,000 essential workers, 72% are renters, which is why the NSW, Victorian and Federal Governments are offering deals to part own the house or apartment with the essential worker to ensure we have the people we need close to these essential jobs.

And while housing price falls in the $1-5 million range are down by as much as 12%, the Reserve Bank is reporting property sub-$1 million has gone up by 6-7%.

Australia is currently reviewing more than 2.2 million VISA applications, so we know the demand for housing is only going to go up, significantly and quickly.

My message is not to wait until next year to buy your next property.

The reality is that there is time now to hit the ground running before Christmas. It gives you the jump on others who will be two months behind you if they don’t act until after Australia Day.

Which brings me to a very special opportunity this festive season…

I have just announced what I consider the most exciting estate at Coomera we’ve ever done. With a total 35 lots, we have nine remaining available for sale. I have personally bought seven in a row – this is a first for me, which I think speaks volumes for the potential growth I see here.

All sites have dual occupancy and returns 6%. The reason this will be the best real estate in Australia is because of the density.

Coomera’s population is going to explode from its current 25,000 to over 90,000 in the next 15 to 20 years, which will require high density, such as the development next to our estate which is high density 10 to 12 storeys.

This isn’t one to miss out on. Let me know if you’d like to be my neighbour investor.

Thought I’d wrap up with my hot tips for Christmas 2022!

- Be bold

- Buy a property in our new Coomera estate

- Don’t go for fixed rates. Strong prediction is that interest rates will go up and back down, they’ll settle around 2.5% and the cash rate will find a number around 2.5%, it’s at 3.1% now. No point fixing into interest rate right now

- Your home loan is the most important to pay down, use depreciation and tax benefits from your investment properties to pay down your principal place of residence

- When you are buying an investment property, if you have debt on your own home, use those new properties to accelerate the payment down of your principal place of residence

- Get coached on goal setting – have a sounding board on goals

Wishing everyone a wonderful festive season,

JF