The most important email for you to read during COVID-19.

Property prices are going to explode, and you will be surprised how quickly and by how much. Here’s why…

1. Record prices are being set

A house sold in Sydney this month for $95 million, which is more than 30% higher than the previous record for an amalgamation of $70 million set in 2016.

That’s not all, a cattle station sold in Queensland for $35m at auction, setting a new record with 11 bidders starting at a whopping $20 million.

On the Gold Coast the riverfront record was smashed with not one but multiple $12 million+ sales and a beachfront home sold for $25 million, with the buyer planning to pull it down.

Around the country, street and suburb records are being broken.

We now know, exactly what we said would happen: when Australia opened up briefly at the end of July property prices officially went up in Sydney, Brisbane, Adelaide, Canberra and Perth.

Even the banks and economists are back peddling: ”parking the Melbourne issues to one side, what has genuinely surprised us is the resilience of house prices in some of the other capital cities, considering the negative shock to the labour markets around the country” a CBA economist said.

House Prices are also rising in USA, UK and Europe as they try to get back to normal due to low interest rates as well.

2. Interest rates are at record lows

We have never seen the borrowing rate under 2.5%. More importantly, prior to COVID-19, prices were going up 1% per month around the country when that average borrowing rate for investors was circa 4.5%. Borrowing $1m in January would cost you $900 per week. Today’s interest costs for $1 million are as low as $400 per week. That’s massive. It’s the biggest game changer we have ever seen, given liquidity levels.

Home buyers rushed back to their banks in July, new loan commitments went up 11.8% from their level a year earlier. New mortgage commitments – excluding the refinancing of existing loans – to owner-occupiers rose 10.7% from June to $14.3 billion, the biggest month-on-month gain since 10.9% in March 2009, when the country was climbing out of the GFC. Borrowing $1m during the GFC would have cost you over $1,200 per week and yet house prices went up 11% in 2010.

July record mortgage commitments followed June’s 14.9% increase – also a monthly record.

The number of loans for the purchase of land jumped 30% to 4096 in July, from 3,151 in June, which itself marked a 36% pick-up from May’s 2,321.

3. Liquidity is at an all-time high

The household savings rate has jumped to a 46-year high of 19%.

A record $48 billion in government cash flowed into households in the three months to June. On top of that, early access to superannuation added $18.1 billion, while loan and rent deferrals helped households save another $1.5 billion. And this is separate from the rent and interest rate reductions that have boosted cash flow since the start of the pandemic.

Households are awash with cash, and the numbers have only increased since the June quarter. As of early September, government cash out the door stands at $85.3 billion, and superannuation withdrawals are now more than $35 billion.

On top of all that, the Reserve Bank of Australia has provided all banks with access to about $200 billion of three-year funding at a cost of just 0.25% annually. The RBA even increased this by $57 billion last week, even though the banks say they do not need the liquidity.

During the GFC, our aggregate domestic deposits was circa $700billion. Today it is over $2.2 trillion with the deposit rate around 1%. The banks don’t need your money, it’s cheaper for them to access RBA money at 0.25%.

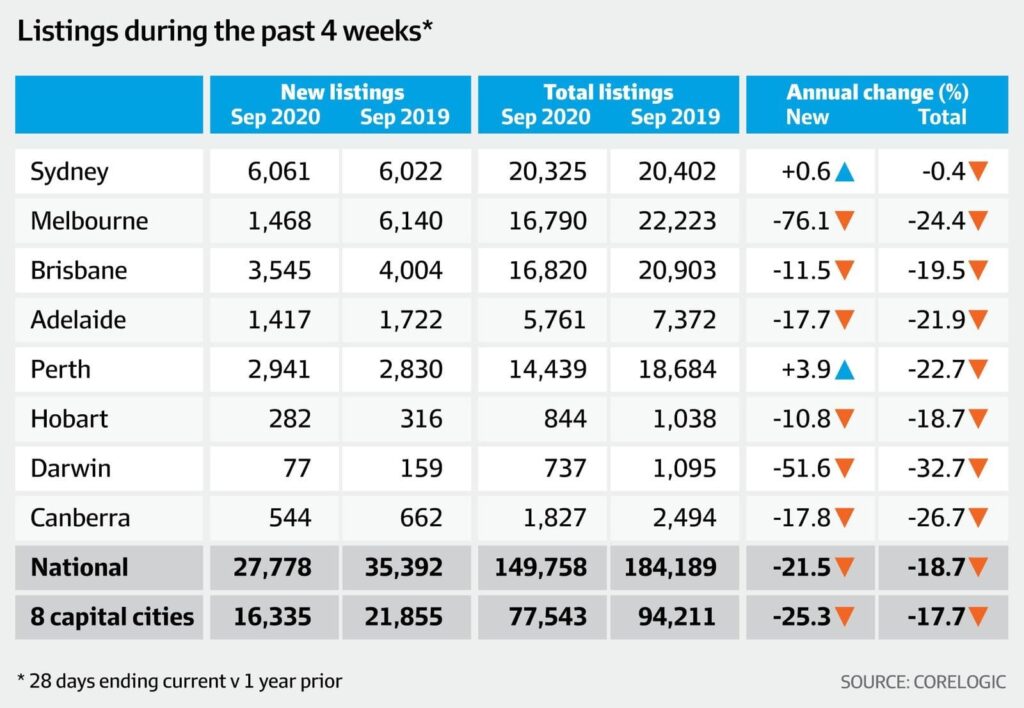

4. Listings are down 20%

Agents are reporting that their biggest challenge is that listings are down more than 30% in some markets and renters looking to take advantage of low interest rates given, it may be cheaper to buy than rent and expats returning are being squeezed in the market.

- New stock coming onto the market is at 50-year low

New apartment project launches totalled 23 nationally in the June quarter, down from 60 in the same period a year ago. There were just 55 launches in the first half, putting the country on track this year to record half of last year’s total 199 launches, itself half of the 2015-2018 average of 407 projects, the Urbis Q2 Apartment Essentials Report shows

- Population growth is higher than forecast.

All forecasts about migration have not taken into account the 1 million expats potentially returning. Normally we have 500,000 new migrants and 300,000 Australians leaving each year. No one is leaving and as many as 4,000 per week are coming home, which is a normal year.

This is not to mention the agents reporting demand from overseas from places like Hong Kong who plan to move here when possible.

- First home buyer stimulus is underpinning any supply

With the stimulus from state and federal government as high as $50,000 per house, land sales and even apartment projects are selling fast. On the ground we have seen land prices increase $20,000-$40,000 per lot since June.

- Rental market is much tighter

I have had a number of tenants in my houses asking if they can buy the house. One has been there 11 years. Of course I said no. Rental vacancy rates where we invest are below 1% and rents are going up in our markets. Yes, rental vacancy rates reported in some areas at 2%, but mostly CBD apartments.

I’m pleading with you to do whatever you can to buy more property now while it is cashflow positive, and before the price explosion I can see, as clearly as the nose on my face. Post COVID-19, like other countries now, house prices will explode due to low interest rates and strong migration. If you’re in any doubt that we will boom post COVID-19, watch the interview I did with demographer Bernard Salt last week.

It’s one of the most unique opportunities you will ever have as an investor to build a portfolio and quickly.

I myself recently completed 2 new houses in Melbourne and since then, I have bought another 8. I’m doing exactly what I’m telling you to do. South East Queensland and Adelaide will have record interstate and overseas migration on the back of COVID-19. As I said earlier, I expect 60% price growth there in the short term.

It’s a once in a lifetime opportunity. Make the most of every crisis.