Step 1 – Buy Land for Growth

Melbourne median house price entered its third phase with the outer ring now growing at a faster pace than the two inner rings.

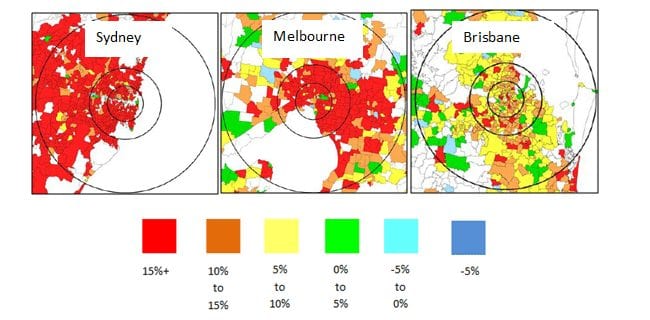

You’ll recall on our mid-year webinar we showed the overlays of Sydney, Melbourne and Brisbane growth in this cycle at it was like looking at a time delayed glimpse of the cycle. Sydney is now all red, Melbourne just under 50% but spreading out and Brisbane just on 5-10% red zone.

Why are we saying this?

We put our first few clients in Melbourne (2007) and Sydney (2010). Today the growth in land value is astounding.

In Melbourne our first clients in Wyndham Waters, now part of Williams Landing, for $200/ m². With comparable lots, these are now worth well over $600/ m².

We put our first Sydney clients into Pemulwuy, buying land for just over $600/ m², now selling for $1,300 – $1,500/m²

We believe some parts of Brisbane are next.

Is Market slowing down?

There’s lots of commentary about ‘housing prices’ but no data to suggest any slowdown.

The worry seems to be Sydney but from my perspective it’s just following trend and will continue to increase in value until at least 2018, assuming interest rates don’t spike before then.

What is interesting is that investor loans are down 21% since last year and owner occupiers are now the dominant force in the markets.

Looking at Sydney and Melbourne the auction clearance rates are up on last year’s numbers with Sydney repeatedly above 80% clearance each week. That’s very strong. Listings across the country are down from their peaks in 2012 where there were 140,000 properties for sale. Today it’s just on 100,000 with Sydney and Melbourne maintaining a healthy demand supply ratio. Brisbane listings are on my radar as that market picks up and supply gets tight.

Everyday more and more economists allude to the fact that the boom is coming to an end, and we are going to experience a ‘GFC’ like experience. So let’s get real. Buyers are showing no signs of slowing down. The demand is still there but supply is lacking.