If you were around in the seventies, that was the ABBA song you couldn’t get out of your head.

Today it’s a reality as Governments around the world print money to buy their way through this pandemic. While Australia is not technically printing money, it is certainly borrowing big time. Our total Government debt was less than $1 trillion when the pandemic started, it’s now sitting around $1.3 trillion and possibly heading toward $1.75 trillion in the next five years. Having said that, the cost of borrowing $1.3 trillion today would actually be much less than it cost to borrow even $1 trillion, two years ago.

The United States Federal Reserve has just announced they will continue to pump $US120 billion a month into their economy and the Reserve Bank of Australia yesterday announced another $100 billion worth of bond buying. It also revealed interest rates won’t go up until 2024.

So how does that effect you, me, and property? The answer to that is massively!

Asset prices are going nuts. I say nuts because companies on the stock market are running purely based on rumours; GameStop is a good example. All assets are going up because of the cheap money around and there is a lot of money around. Australians’ bank balances have gone up by $113 billion or 11.4% since COVID started and interest rates have dropped from 4.5% to less than 2%, which means the cost of money to buy a home has now halved.

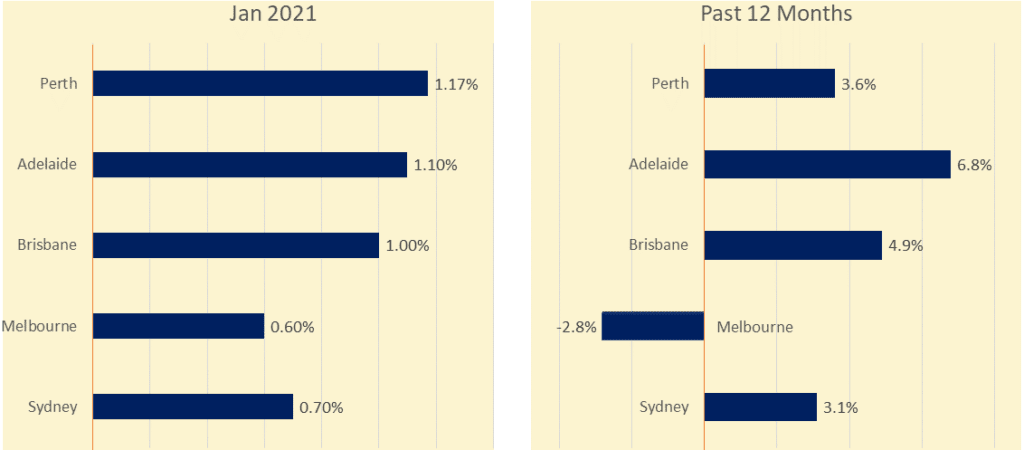

In the graph above you will see that house prices in January went up on average by 1% in the capital cities; Sydney and Melbourne (+0.6%), and areas such as Gold Coast increased by 1.6%. In addition to this, house rentals are also on the rise, Brisbane +3.4% in 2020 and Adelaide at +4.1%.

Does it mean house prices will double?

My answer is yes.

Normally they would have all but doubled by 2030 anyway, but with low interest rates this could be much earlier.

Lending is also at record highs and even more importantly driven by owner occupiers and first home buyers, with investors still not playing a huge role in the market. The investor bit has me puzzled. It could be the hangover from when investors tried to obtain finance one or two years ago when the banking inquiry was on and some struggled to get it over the line. The banks were calculating repayments based on interest rates (7.25%) and taking credit card purchases into account when calculating ability to service.

That has all but gone and my understanding is from March that the responsibility of the bank is officially passed to the borrower, the seeds of a future royal commission are being sown.

Let me say, as I always do, if you can buy property now you should. In one to two years, you will be surprised at the growth in value and just as importantly the cashflow benefits for when you retire.

And you’re going to need those cash flow benefits when you retire, because the debt the governments are taking on and welfare at its current levels, can’t be maintained.

If not for you, do it for your country!! Ha…. I’ve been reading too much Trump!!