Welcome to 2016….

Here is a standout number that didn’t get reported last year: the Sydney land price per square metre jumped by 46% in 2015. As Custodians, that tells us a lot.

The median house price in Sydney, according to RP data, rose by 10.7% last year, so let’s face it, the land tells the story better.

Over the past 30 years I have seen each property cycle carry certain distinctions:

- The cycle in the late 80’s early 90’s was dominated by overseas banks entering then leaving Australia, prompting a flow of money in and out of the country in the process.

- The cycle at the end of the century, 1998 – 2004, was when we saw interest rates go from nearly 30 years of double digits to single digits for the first time.

This cycle is predicated by three new factors:

- the rapid increase in population growth in Australia

- the introduction of Chinese buyers to Australia and, in my mind most importantly,

- the more efficient land use where councils are moving towards higher density and significantly lower lot sizes.

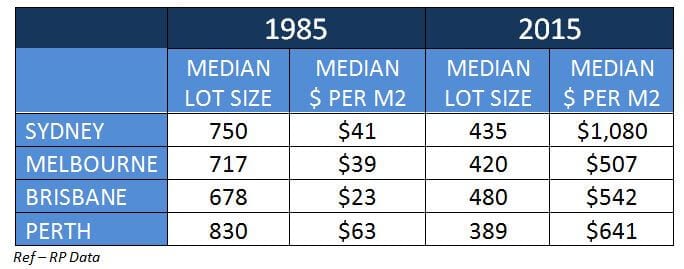

Below is a table of lot sizes and values in each of the states. Let’s compare those with what they were back in 1985:

The Cycle

The first part to jump out from the figures above is how Sydney leaped ahead of the other states. That literally happened last year and I expect other states to follow this cycle.

Let’s look at the 30 year BIG PICTURE

If you do the math, land per square metre has increased by more than double the median house prices in that time, but interestingly the real drop in lot sizes has occurred in the last 10 years. Here are the stats: In 2003, the median lot size in Sydney was 660m², Melbourne 615 m², Brisbane 700 m² and Perth 602 m².

So what does the future look like?

My belief is that by 2020 and beyond, the median lot size will be 250 m². As I’ve mentioned before new lots have emerged in estates that are as small as 75m². I cannot stress enough, this is the last opportunity for many of us who may not qualify for bank loans by the time the next boom comes, in 2025. My view is, and always was, that land is the key to wealth. I can easily visualise in 5-10 years my 600m² lots having 3-4 tenants in them, rather than 1.

This year is seeing markets again pushing ahead. Melbourne jumped over 2% in January. The Reserve bank has once again kept interest rates on hold with half of the economists saying it will fall, and the other half saying it will rise. It’s been static since May last year. Honestly I don’t think anyone knows; but here is a fact: banks edged rates up last week and long term rates have also been creeping up. I’ve been locking in again.